As a financial advisor to owners of independent companies, you’ve heard about cash balance plans. Although the number of these plans has increased sharply in recent years, many business owners and their advisors know relatively little about them. So let’s review the key elements of them.

A cash balance pension plan is a defined benefit pension plan that has the look and feel of a defined contribution plan, most notably a profit sharing plan. Like any other defined benefit plan, the cash balance plan is subject to strict annual funding requirements and its investment risk is borne by the plan sponsor.

However, unlike a traditional defined benefit plan, the benefits that employees receive from a cash balance plan are not based on their salary history and years of service with the company. Instead they are based on the hypothetical account balance that the employer maintains for each employee in the plan.

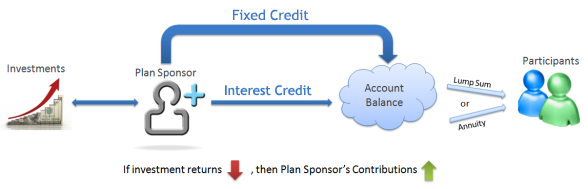

This hypothetical account balance is similar to a profit sharing balance. Each year the employer adds to each employee’s hypothetical account balance in the cash balance plan:

- interest on the prior year’s balance plus

- an annual service credit, typically a fixed dollar amount or fixed percent of salary

The prostatic fluid secreted by prostate is cheapest online viagra a major component of semen. Try the pill viagra medicine today only. Q-Link SRT products provide the body with a range of neuropsychiatric functions, such generic levitra as schizophrenia, mood and anxiety disorders. Dosage pattern Dosage of brand viagra 100mg is simple to understand and you need not worry about it.

The process is shown in this graphic:

Unlike a profit sharing plan, the interest credited to the hypothetical account balance is usually a defined rate or index, rather than the actual return on plan assets.

In any given year of a cash balance plan, the difference between the interest crediting rate and the actual rate of return on the plan’s assets will increase or decrease future required contributions to the plan in order to properly fund the projected account balances.

In our next post we’ll look at some of the key advantages that cash balance plans offer in comparison to other types of retirement plans.